Home Equity Line of Credit

As a homeowner, you can convert the equity in your home to cash with a Home Equity Line of Credit (HELOC).

Ready to get started? Apply online or call us at (800) 533-0035, Option 3.

Apply Now

Loan Loyalty Discount

You could receive a 0.25% APR^ discount on a fixed-rate HELOC when you have multiple loans with us.

^APR = Annual Percentage Rate

WHAT IS HOME EQUITY AND HELOC?

Home equity is the difference between the value in your home and how much you owe on your mortgage. You can convert the equity in your home into cash to cover a big dollar expense such as home improvements. HELOC is an acronym that stands for Home Equity Line Of Credit.

With a HELOC, you don't need to refinance your house or adjust your current mortgage payments. A HELOC is a line of credit that has an initial draw period of 5 or 10 years during which you can access the funds whenever you need them or withdraw in one lump sum. Payments on your loan begin whenever you make a withdrawal and must be repaid in 10 or 15 years, depending on the terms of your loan.

How can I use home equity?

A HELOC loan is typically used for a planned large expense. Common uses include home repairs and renovations, vacation, business start up or education expenses. Depending on current marketing place rates, HELOC can also be used to for debt consolidation or emergency funds.

- In some cases, it may be more beneficial to consider a cash-out refinance, where you replace your existing mortgage with a new one and take out equity at the same time. Speak with a home equity or mortgage specialist to determine which option is best for you.

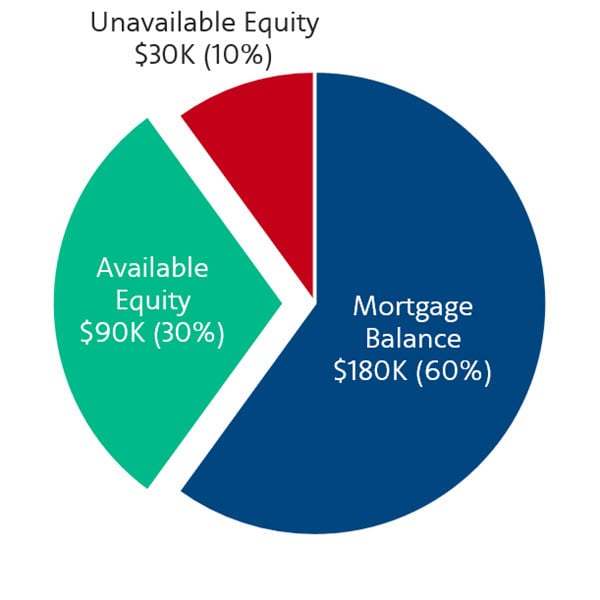

How much equity do I have?

When calculating how much of a limit you want for a HELOC, it's important to know how much equity is available. Your available equity is equal to 90% of your property's value (80% in Texas), minus any outstanding mortgage balance. Take a look at this chart which shows an example of available equity in a property with a $300,000 value:

For example: A property not in Texas that is valued at $300,000 and with a mortgage of $180,000 could have a HELOC with a limit of up to $90,000.

How can I use home equity?

A HELOC loan is typically used for a planned large expense. Common uses include home repairs and renovations, vacation, business start up or education expenses. Depending on current marketing place rates, HELOC can also be used to for debt consolidation or emergency funds.

- In some cases, it may be more beneficial to consider a cash-out refinance, where you replace your existing mortgage with a new one and take out equity at the same time. Speak with a home equity or mortgage specialist to determine which option is best for you.

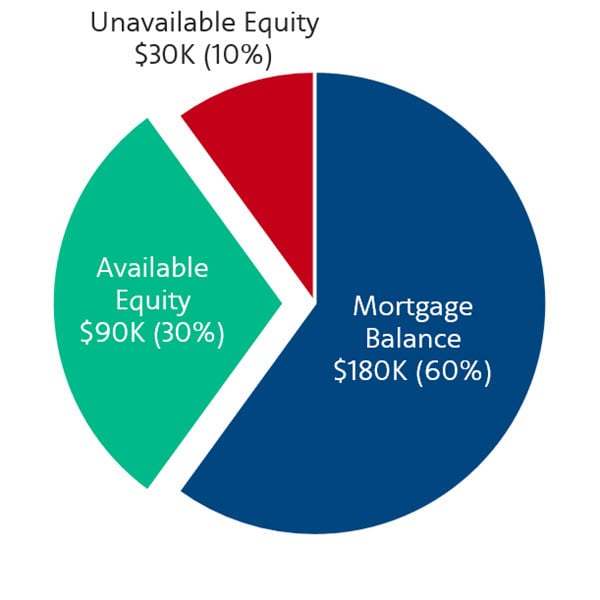

How much equity do I have?

When calculating how much of a limit you want for a HELOC, it's important to know how much equity is available. Your available equity is equal to 90% of your property's value (80% in Texas), minus any outstanding mortgage balance. Take a look at this chart which shows an example of available equity in a property with a $300,000 value:

For example: A property not in Texas that is valued at $300,000 and with a mortgage of $180,000 could have a HELOC with a limit of up to $90,000.

YOUR HELOC IS JUST A FEW STEPS AWAY.

1. Prepare your finances. Calculate the available equity in your home. Review your monthly spending and budget to see how much of a payment you can afford.

2. Start your application. Be ready with all your documents. You’ll need income, tax and housing documents such as paystubs, W-2, mortgage statements and property tax information.

For a detailed checklist, click here.

3. Allow time for your loan to process. Your loan officer will conduct a thorough review of all documents and will reach out to you if they have any additional questions. Due to the complexity of this loan, a HELOC is not processed as quickly as an auto or credit card loan.

4. Finalize the loan. Like a mortgage, a HELOC requires an in-person closing appointment and paperwork to complete. Once your application is finalized, your loan officer will assist you in scheduling the appointment.

5. Access your funds. You can draw on your account for 5 or 10 years, depending on the terms of your loan. You can access your money via online banking or convenience checks but note that if you live in Texas, you must make a request in writing.

HELOC Options

Check out our various HELOC products to see what meets your needs.

Fixed-Rate HELOC

Our fixed-rate HELOC is great for homeowners who want a predictable payment when accessing their funds. This option is available for all states except Texas.

- Borrow up to 90% of the value of your home, less your first mortgage balance. Interest is only charged while there's a balance.

- Access funds through online banking or request convenience checks.

- Interest rate is fixed for the term of the loan.

- There's no prepayment penalty.

- Take funds from your HELOC for up to five years and pay it back over 10 or 15 years.

- Available for non-owner occupied property. Speak with a loan officer for more information about this option.

Variable-Rate HELOC

Our variable-rate HELOC is great for homeowners who want the option of a longer draw period when accessing funds from the line of credit. This option is available for all states except Texas.

- Borrow up to 90% of the value of your home, less your first mortgage balance. Interest is only charged while there's a balance.

- Access funds through online banking or request convenience checks.

- Interest rate adjusts quarterly based on the Prime Rate. The annual percentage rate can change quarterly on the first day of January, April, July and October.

- There's no prepayment penalty.

- Take funds from your HELOC for up to five or 10 years and pay it back over 10 or 15 years, respectively.

Texas Fixed-Rate HELOC

Our fixed-rate HELOC is great for homeowners who want a predictable payment when accessing their funds. This option is only available for Texas properties.

- Borrow up to 80% of the value of your home, less your first mortgage balance. Interest is only charged while there's a balance.

- Interest rate is fixed for the term of the loan.

- There's no prepayment penalty.

- Take funds from the HELOC for up to five years and pay it back over 10 or 15 years.

- When you take funds from your HELOC, there's a minimum amount of $4,000. Requests for funds must be in writing with your signature.

- Available for non-owner occupied property. Speak with a loan officer for more information about this option.

Texas Variable-Rate HELOC

Our variable-rate HELOC is great for homeowners who want the option of a longer draw period when accessing funds from the line of credit. This option is only available for Texas properties.

- Borrow up to 80% of the value of your home, less your first mortgage balance. Interest is only charged while there's a balance.

- Interest rate adjusts quarterly based on the Prime Rate. The annual percentage rate can change quarterly on the first day of January, April, July and October.

- There's no prepayment penalty.

- Take funds from your HELOC for up to five or 10 years and pay it back over 10 or 15 years, respectively.

- When you take funds from your HELOC, there's a minimum amount of $4,000. Requests for funds must be in writing with your signature.

Our Rates^

-

APR as low as

5.448%

15-Year Fixed

Home Loans

-

APR as low as

6.075%

30-Year Fixed

Home Loans

-

APR as low as

6.085%

5/1 Arm (30-Year)

Home Loans

-

APR as low as

7.250%

5/10 Fixed

Owner Occupied HELOC

^Home Loan Rates and Information and HELOC Rates and Information

Rates Subject to Change. APR=Annual Percentage Rate. Rates Effective December 19, 2025. View Full Disclosures.

Our Rates^

-

APY as high as

1.87%

Savings

Share/IRA Accounts

-

APY as high as

4.05%

Short-Term Share Certificate

Share Certificate

-

APY as high as

4.00%

Share Certificate

Share/IRA Certificates

-

APY as high as

4.07%

Ladder Certificates

Share/IRA Certificates

-

APY as high as

0.40%

Priority Checking

Checking Accounts

-

APY as high as

0.25%

Flagship Checking

Checking Accounts

Rates Subject to Change. APY=Annual Percentage Yield. Rates Effective February 1, 2026.

Our Rates^

-

APR as low as

3.74%

New Auto

Up to 36 Months

-

APR as low as

4.24%

Used Auto

Up to 36 Months

-

APR as low as

4.49%

New Auto

Up to 60 months

-

APR as low as

4.99%

Used Auto

Up to 60 months

-

APR as low as

6.99%

RV

Vehicle Loans

-

APR as low as

6.74%

Boat/Airplane

Vehicle Loans

Rates Subject to Change. APR=Annual Percentage Rate. Rates Effective December 19, 2025.

Our Rates^

-

APR

14.25% - 16.25%

Signature Cash Back

Credit Cards

-

APR

12.00% - 17.74%

Platinum Rewards

Credit Cards

-

APR

10.50% - 18.00%

Platinum Low Rate

Credit Cards

-

APR

15.74%

Platinum Secured

Credit Cards

Rates Subject to Change. APR=Annual Percentage Rate. Rates Effective January 1, 2026.

Our Rates^

-

APY as high as

0.15%

Business Checking

Checking Accounts

-

APY as high as

0.40%

Business Savings Account

(Share) Savings Accounts

Rates Subject to Change. APY=Annual Percentage Yield. Rates Effective February 1, 2026.

Our Rates^

-

APR

12.24% - 18.00%

Platinum

Credit Cards

Rates Subject to Change. APR=Annual Percentage Rate. Rates Effective January 1, 2026.

Our Rates^

APR as low as

5.448%

15-Year Fixed

Home Loans

APR as low as

6.075%

30-Year Fixed

Home Loans

APR as low as

6.085%

5/1 Arm (30-Year)

Home Loans

APR as low as

7.250%

5/10 Fixed

Owner Occupied HELOC

^Home Loan Rates and Information and HELOC Rates and Information

Rates Subject to Change. APR=Annual Percentage Rate. Rates Effective December 19, 2025. View Full Disclosures.

APY as high as

1.87%

Savings

Share/IRA Accounts

APY as high as

4.05%

Short-Term Share Certificate

Share Certificate

APY as high as

4.00%

Share Certificate

Share/IRA Certificates

APY as high as

4.07%

Ladder Certificates

Share/IRA Certificates

APY as high as

0.40%

Priority Checking

Checking Accounts

APY as high as

0.25%

Flagship Checking

Checking Accounts

Rates Subject to Change. APY=Annual Percentage Yield. Rates Effective February 1, 2026.

APR as low as

3.74%

New Auto

Up to 36 Months

APR as low as

4.24%

Used Auto

Up to 36 Months

APR as low as

4.49%

New Auto

Up to 60 months

APR as low as

4.99%

Used Auto

Up to 60 months

APR as low as

6.99%

RV

Vehicle Loans

APR as low as

6.74%

Boat/Airplane

Vehicle Loans

Rates Subject to Change. APR=Annual Percentage Rate. Rates Effective December 19, 2025.

APR

14.25% - 16.25%

Signature Cash Back

Credit Cards

APR

12.00% - 17.74%

Platinum Rewards

Credit Cards

APR

10.50% - 18.00%

Platinum Low Rate

Credit Cards

APR

15.74%

Platinum Secured

Credit Cards

Rates Subject to Change. APR=Annual Percentage Rate. Rates Effective January 1, 2026.

APY as high as

0.15%

Business Checking

Checking Accounts

APY as high as

0.40%

Business Savings Account

(Share) Savings Accounts

Rates Subject to Change. APY=Annual Percentage Yield. Rates Effective February 1, 2026.

APR

12.24% - 18.00%

Platinum

Credit Cards

Rates Subject to Change. APR=Annual Percentage Rate. Rates Effective January 1, 2026.

HELOC FAQ

Once the initial draw term ends, you need to apply for a new HELOC in order to begin a new draw term of your desired length.

You may access all of the available funds in a single draw. In most states, there's no minimum amount for making a draw. In Texas, whenever you make a draw, there's a required minimum of $4,000.

We cover most of the fees associated with processing your HELOC application. Some applications may need a full title policy or appraisal which is a cost you would pay. Your loan officer will let you know if these are necessary and get your approval before proceeding.